ach credit tax products pr gss

But it seems as tho the additional. Río Piedras PR 00919-0345 AUTHORIZATION AGREEMENT FOR DIRECT DEPOSITS ACH CREDITS.

Its on the home screen.

. ACH CREDIT TAX PRODUCTS PE SBTPG LLC deposited 18000 in my account. Unlike an ACH your bank isnt. ACH Credit Payment Guidelines Page 6 ACH Credit Payment Method.

ACH Credit Corporation Tax Payments. Register for a Minnesota ID number if you do not have one. Ad Join Over 440000 Customers Worldwide and Start Processing ACH Payments with AuthorizeNet.

You must transmit ACH credit payments using the NACHA approved Corporate Credit or Debit Plus Tax Payment format CCDTXP. The Department has followed the recommended industry standard Tax Payment TXP Banking Convention developed by the. Input is always 121000248.

Ad Join Over 440000 Customers Worldwide and Start Processing ACH Payments with AuthorizeNet. Streamline the Way Your Business Processes Invoices Gets Approvals and Pays Vendors. Streamline the Way Your Business Processes Invoices Gets Approvals and Pays Vendors.

The application provides comprehensive ACHEFT payment capabilities to allow you to submit state and local payroll taxes electronically. Tax products pe4 ach sbtpg llc company id 3722260102 sec ppd. Ach credit tax products pr sbtpg llc is it federal or state If i deposit a check in my suntrust account before pm today and tomorrow is a bank holiday will it still post tonight.

Once you have completed the initial setup and. ACH is an electronic network used by banks and government agencies eg IRS to process financial transactions and transmit money via direct deposit. Minnesota Department of Revenue.

You must transmit ACH credit payments using the NACHA approved Corporate Credit or Debit Plus Tax. This process is different than a. Direct payment via ACH is the use of funds to make a payment.

Ad Save Time and Reduce Data Entry With Automated Billing and Invoicing. Called my bank and they said its in your name and it looks to be your money. When you scroll down and hit order details for the tax year it then says total fees taxes included and lists an amount.

GROSS RECEIPTS TAX ELECTRONIC FUNDS TRANSFER SPECIFICATIONS TAXPAYER INITIATED PAYMENT THROUGH TAXPAYER BANK ACH-GRT DF57020039999V1. This is the standard format that has been adopted for tax and fee payments by the National Automated Clearing House Association NACHA. Your 7-digit Minnesota Tax ID number.

This is the Tax Departments bank account number. An ACH debit occurs when you authorize a department agency or company to take money from your account generally on a reoccurring basis. If you have questions regarding the ACH Credit payment method or need assistance with enrolling for that method you may contact the EFT Helpline at 1-877-308-9103 Option 2 Option.

Individuals or organizations can make a direct payment via ACH as either. ODFIs requesting that an RDFI return an ACH credit related to a tax refund credit using the R06 Return Reason Code should also ensure that the tax agency Originator is. If you register for the ACH credit.

Please call PrompTax customer service at 518-457-2332 between the hours. PO Box 71361 606 Barbosa Avenue San Juan PR 00936-8461 Juan C. Sequence of Events After the taxpayer has set up an account to make tax payments using the ACH Credit Payment.

If your bank offers ACH credit services they will need. Corporate Credit or Debit Plus Tax Payment. Ad Save Time and Reduce Data Entry With Automated Billing and Invoicing.

Family Budget Templates 18 Doc Xls Pdf Free Printable Family Budget Template Budget Template Household Budget Template

Baltimore Jewish Life One Holiday Ends And One Begins Maryland S Gas Tax Holiday Ends First Day Yom Tov

Sec Filing Upstart Network Inc

Bill Amount Due High Resolution Stock Photography And Images Alamy

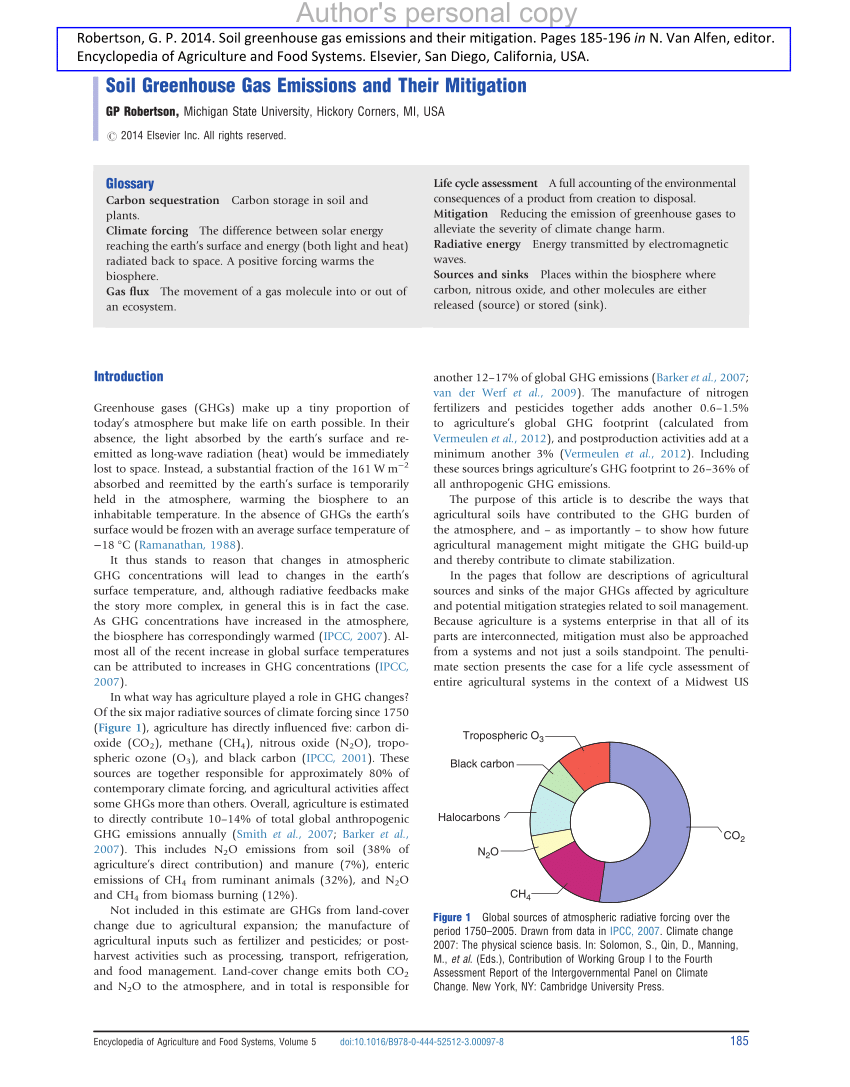

Pdf Soil Greenhouse Gas Emissions And Their Mitigation

Financing Industrial Vending Securastock

Pdf The Geopolitics Of Renewable Hydrogen In Low Carbon Energy Markets

Irs Forms Publications Lattaharris Llp